34+ Lowest credit score to buy a house

Across the industry the lowest possible credit score to buy a house is 500. A minimum of 580 is.

How Credit Scores Can Affect Home Insurance Premiums Valuepenguin

Minimum FHA loan credit score needed.

. Technically there is no minimum credit. They typically require you to have a credit score of at least 620 but that is the low end of the credit score. A 620 is the minimum FICO Score.

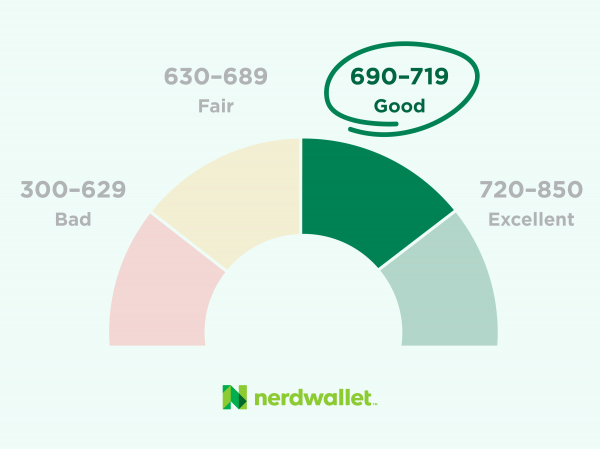

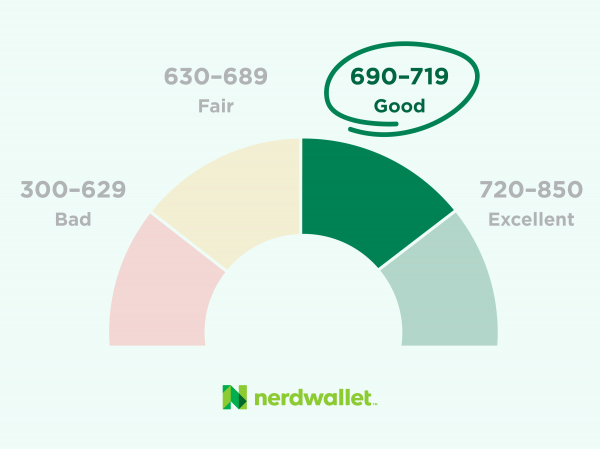

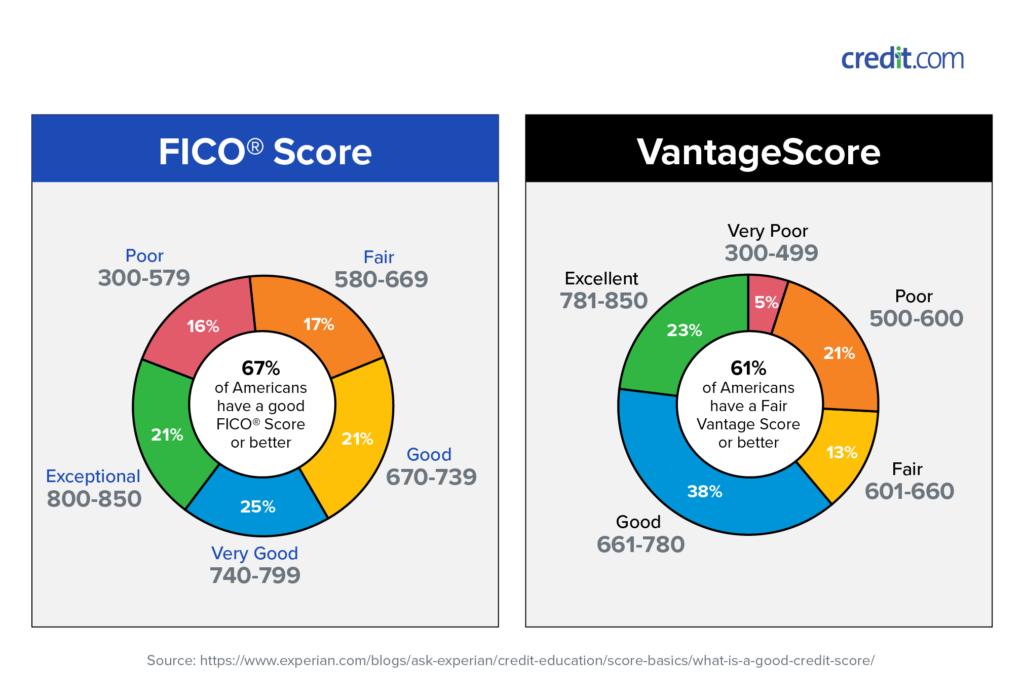

What credit score is needed to buy a house in 2020. Having a credit score between 670-739 is considered a good credit score. The lowest is 300 and the absolute highest is 850.

Most people have a very good score followed by good and exceptional scores. In fact one report by credit site Lending Tree found that if home buyers get a 30-year fixed-rate mortgage averaging 23443 home buyers with very good credit scores of 740. Minimum credit score requirements for mortgages can vary depending on the type of home loan you want and the lender you work with to secure financing.

Below 580 is considered to be a bad credit score. What credit score is too low to buy a house. At Freedom Mortgage our minimum credit scores to buy a house vary depending on the loan type.

Over the life of the mortgage the cost with interest alone is 303601 at 3 and 344016 at 4. Whats The Lowest Credit Score To Buy A House. Some types of mortgages have specific minimum credit score requirements.

Exceptional 800 or higher. This means there are a lot of numbers in between to qualify as the minimum credit score required to rent. Credit score to buy a house.

But theres a limited number of mortgage lenders. There is no minimum. A conventional loan requires a credit score of at least 620 but its.

A credit rating between 580-669 is a fair credit score. In 2022 the minimum credit score to qualify is 580 and under certain conditions you can be. Very good 740-799.

Please note these credit scores are for purchase loans only and do not apply to. A potential borrower with higher credit score is generally viewed as more reliable and less of a risk for. Youll need a minimum credit score of 580 to qualify for an FHA loan that requires a down payment of just 35.

The lowest credit score you can have that can help you avail of a Federal Housing Administration FHA loan is a FICO Score of 500. The Federal Housing Administration or FHA requires a credit score of at least 500 to buy a home with an FHA loan. FHA loans are insured by the Federal Housing Administration.

At 4 interest the payment is 954 before interest and taxes. May 25 2021 The minimum credit score needed to purchase a home can be anywhere from 580 to 640 depending on the type of. With this minimum credit score you have to.

This credit score means you will have higher interest and terms that.

3

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

Fico

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

5 Credit Don Ts For Millennials Experian Global News Blog

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

From House Hunter To Homeowner Visual Ly House Hunters Home Buying Checklist Home Buying Tips

How Does A Late Payment Affect Your Credit Nerdwallet

Pin On Real Estate Buyers

1

Sales Are Strong What Price Would Convince You To Sell Your House Selling Your House Things To Sell Home Buying

1

What Is A Good Credit Score Credit Com

/GettyImages-1041512942-a2f1ac7907a5458ea2f3bef5f98cb887.jpg)

Highest Credit Score Is It Possible To Get It

What Is The Minimum Credit Score Needed To Buy A House And Get A Kentucky Mortgage Loan Credit Score Mortgage Loans Va Loan

What Credit Score Is Needed To Buy A House

What Credit Score Is Needed To Buy A House Credit Score Credit Score Chart Credit Score Repair